Navigating Healthcare After Job Loss: Options and Strategies for Coverage

Losing your job is stressful enough without the added worry of losing your healthcare coverage. For many individuals in Western countries, health insurance is tied to employment, leaving them vulnerable during times of economic uncertainty and widespread layoffs. Taqtik Health explores the options available to ensure you can access quality healthcare even when you’re between jobs.

The Healthcare Conundrum of Job Loss

In countries where employer-sponsored health insurance is the norm, job loss often equates to the sudden loss of access to critical healthcare services. For families, the financial and emotional strain can be overwhelming. However, a range of options exists to help bridge the gap and ensure your health isn’t compromised.

1. Understand Your Current Coverage

Before making any decisions, it’s important to assess your current health insurance plan. Many plans offer a grace period or continuation options under certain laws and policies, which can provide temporary coverage while you explore long-term solutions.

COBRA Continuation Coverage

In the United States, the Consolidated Omnibus Budget Reconciliation Act (COBRA) allows individuals to continue their employer-sponsored health insurance for up to 18 months. While COBRA can be expensive—since you’ll need to pay the full premium—it provides continuity of care and protects you from unexpected medical expenses during your transition.

2. Government-Funded Healthcare Programs

Depending on where you live, government-funded programs may provide an alternative to employer-sponsored coverage. These programs often cater to unemployed individuals, low-income families, or those with specific health conditions.

Medicaid and CHIP

In the U.S., Medicaid provides free or low-cost coverage to eligible individuals and families. The Children’s Health Insurance Program (CHIP) ensures that children in low-income households have access to healthcare services.

Universal Healthcare Access

Countries with universal healthcare systems, such as Canada or the U.K., ensure that basic healthcare services remain accessible regardless of employment status. However, additional private insurance may be necessary to cover services not included in these systems.

3. Private Health Insurance Options

Private insurance plans can be purchased directly from insurers or through health insurance marketplaces. These plans come with varying levels of coverage and costs, allowing you to choose one that fits your needs and budget.

Health Insurance Marketplaces

In countries like the U.S., health insurance marketplaces established under the Affordable Care Act (ACA) offer a wide range of plans with potential subsidies based on income. Open enrollment periods and special enrollment windows triggered by job loss allow you to secure coverage quickly.

4. Short-Term Health Insurance

Short-term health insurance plans provide coverage for a limited duration, typically 1–12 months. These plans are less expensive than traditional health insurance but may come with limited benefits and exclusions for pre-existing conditions.

Pros of Short-Term Plans

- Affordable monthly premiums

- Quick approval process

- Flexibility to bridge the gap while seeking full-time employment

Cons of Short-Term Plans

- Limited coverage for essential health benefits

- May exclude individuals with pre-existing conditions

- Not renewable in many cases

5. Health Savings Accounts (HSAs)

If you previously had a high-deductible health plan (HDHP), you might have funds saved in a Health Savings Account (HSA). These accounts allow you to pay for qualified medical expenses tax-free, offering a financial cushion during times of unemployment.

Maximizing HSA Benefits

- Use HSA funds for doctor visits, prescription medications, and over-the-counter health products.

- Avoid withdrawing funds for non-medical expenses to maintain tax advantages.

6. Community Healthcare Resources

Many communities offer low-cost or free healthcare services for uninsured individuals. These resources can provide essential care while you work to secure long-term health insurance.

Community Health Centers

Nonprofit clinics and health centers provide affordable medical, dental, and mental health services. Federally Qualified Health Centers (FQHCs) in the U.S. are a prime example.

Patient Assistance Programs

Some pharmaceutical companies and nonprofit organizations offer programs to help uninsured individuals access prescription medications at reduced costs or for free.

7. Medical Tourism as a Cost-Effective Solution

Medical tourism is an increasingly popular option for individuals seeking affordable healthcare. Taqtik Health connects patients with accredited international hospitals and clinics offering high-quality care at a fraction of the cost in Western countries.

Popular Medical Tourism Destinations

- Mexico: Affordable dental work, bariatric surgery, and cosmetic procedures.

- Thailand: Renowned for advanced medical facilities and affordable elective surgeries.

- India: Expertise in orthopedic, cardiac, and cancer treatments at competitive prices.

Benefits of Medical Tourism

- Substantial cost savings

- Access to world-class medical professionals

- Comprehensive care packages, including accommodations and recovery support

8. Health and Wellness Communities

Joining a health and wellness community can provide both support and practical advice for managing healthcare costs. Online forums, social media groups, and local meetups can connect you with individuals who have faced similar challenges.

Taqtik Health Community

The Taqtik Health Community offers a platform for sharing resources, tips, and solutions for maintaining health and wellness during unemployment. Members gain access to expert advice and exclusive healthcare packages tailored to their needs.

9. Preventive Care and Lifestyle Adjustments

Prevention is often the best medicine. Adopting a healthy lifestyle can reduce the risk of chronic illnesses and minimize the need for costly medical treatments.

Tips for Maintaining Health

- Stay active with regular exercise

- Follow a balanced diet rich in fruits, vegetables, and lean proteins

- Manage stress through mindfulness, meditation, or yoga

- Keep up with routine vaccinations and health screenings

10. Plan Ahead for Future Security

Job loss is a stark reminder of the importance of financial and health planning. Taking steps now to secure your future can provide peace of mind and financial stability.

Consider Supplemental Insurance

Supplemental insurance plans, such as critical illness or accident insurance, provide additional coverage for unexpected events and are often independent of your primary health insurance.

Build an Emergency Fund

An emergency savings fund can cover essential expenses, including health insurance premiums, during periods of unemployment.

Conclusion: Taking Control of Your Healthcare

Losing your job doesn’t have to mean losing access to quality healthcare. With a proactive approach and a clear understanding of available options, you can protect yourself and your family during times of uncertainty. Taqtik Health is committed to empowering individuals to navigate their health journeys, offering resources and solutions tailored to your needs.

For more information on healthcare options, medical tourism packages, or joining the Taqtik Health Community, contact us today. Your health is our priority, every step of the way.

Taqtik Health RPM: Your Partner in Post-Bariatric Surgery Success

At Taqtik Health, we understand that bariatric surgery is a powerful step toward a healthier, more fulfilling life. But we also know that the journey doesn’t end in the operating room. The real challenge and the real transformation happens in the months and years after your procedure. That’s why we created Taqtik Health Remote Patient...Continue reading→

Post-Bariatric and GLP-1 Post-Care to Maximize Results

Post-Bariatric and GLP-1 Post-Care to Maximize Results | Taqtik Health Introduction Undergoing bariatric surgery or starting GLP-1 (glucagon-like peptide-1) agonist treatments like semaglutide (Ozempic, Wegovy) or tirzepatide (Mounjaro, Zepbound) is a major step toward long-term weight loss and improved metabolic health. But these treatments are only part of the journey. What you do after surgery...Continue reading→

Remote Patient Monitoring for Obesity: A Smarter Way to Support Surgical and Non-Surgical Patients

Losing weight and improving your health is a personal journey—and it doesn’t always require surgery. Whether you're preparing for bariatric surgery, recovering from it, or trying to manage your weight and health without surgery, one thing remains constant: support matters. At Taqtik Health, we believe long-term success comes from daily progress, consistent accountability, and expert...Continue reading→

How Remote Patient Monitoring (RPM) Supports Bariatric Surgery and Diabetes Care

Remote Patient Monitoring for Bariatric Surgery and Diabetes Management Choosing bariatric surgery or committing to better diabetes management is a life-changing decision—and it’s just the start of your journey to a healthier, happier you. Whether you’re preparing for surgery, healing afterward, or working to manage diabetes, having the right support makes all the difference. That’s...Continue reading→

Advancing Value-Based Healthcare Through Cross-Border Health

At Taqtik Health, we are dedicated to delivering value-based healthcare by providing patients with affordable, high-quality, and patient-centered medical solutions. Our platform connects individuals with top-tier healthcare providers worldwide, ensuring they receive the best possible care at the best value through cross-border healthcare. How Taqtik Health Contributes to Value-Based Healthcare 1. Affordable, High-Quality Care Without...Continue reading→

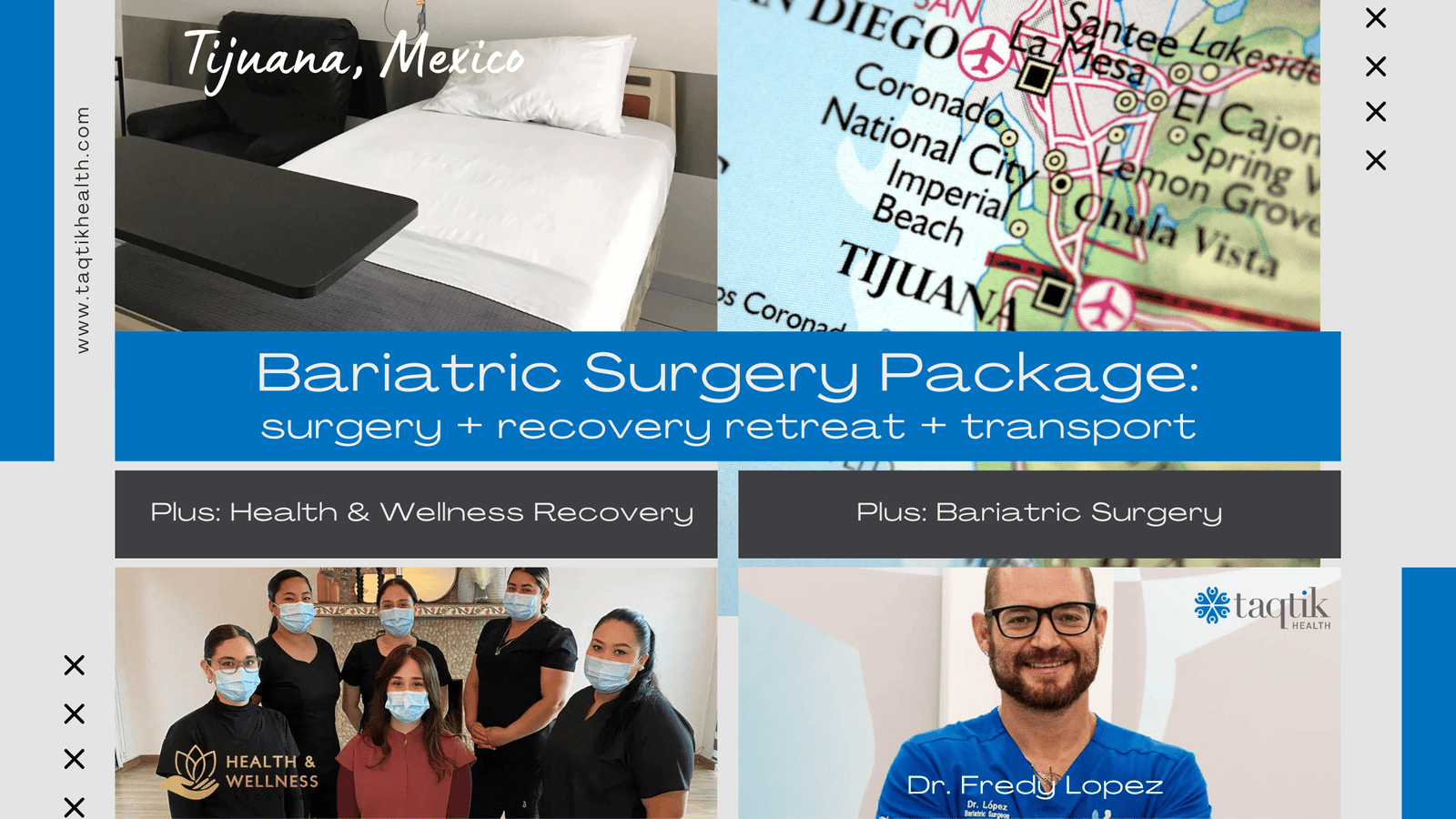

Transform Your Life with Our Bariatric Surgery Promotion in Tijuana Mexico

Transform Your Life with Bariatric Surgery at J.L. Prado Surgical Center in Tijuana, Mexico, with Dr. Fredy Lopez Are you ready to take control of your health and achieve long-term weight loss? Taqtik Health is excited to offer a special promotion for bariatric surgery at J.L. Prado Surgical Center with the renowned Dr. Fredy Lopez,...Continue reading→

Bariatric Surgery Case Study: Kael Sangnam

Background: Kael Sangnam, a 37-year-old with a BMI of 34.7, had been struggling with several health issues, including sleep apnea, shortness of breath, and persistent back pain. Despite various attempts to manage her weight, these health conditions continued to affect her quality of life. Realizing that these conditions were closely linked to her weight, Kael...Continue reading→

How to Choose the Right Bariatric Procedure or Weight Loss Solution

Choosing the right weight loss solution is a deeply personal decision that depends on various factors, including your health, lifestyle, and goals. At Taqtik Health, we understand the complexities involved in making this choice and aim to provide you with comprehensive information to help you make an informed decision. This guide will explore the different...Continue reading→

Transformative Journeys with Taqtik Health: Sarah and Miguel’s Stories of Bariatric Surgery and Total Body Makeover

Introduction The decision to transform one's body and regain health is a profound and personal journey. For many individuals, bariatric surgery is a crucial first step towards achieving a healthier lifestyle. However, the journey doesn't end there. In this blog, we share the inspiring stories of Sarah and Miguel, who chose Taqtik Health to assist...Continue reading→

How to Choose Your Ideal Destination for Bariatric Surgery: Cost Considerations and Factors

Welcome to Taqtik Health, where we pride ourselves on helping you make well-informed healthcare decisions. Bariatric surgery is a life-changing procedure, and choosing the right destination for your surgery is crucial for a multitude of reasons. To make your decision easier, we've put together this comprehensive guide featuring top medical tourism destinations for bariatric surgery:...Continue reading→